Inside Private Capital is GPCA and LAVCA’s collaborative online Executive Education series, which features practitioner-led trainings for private capital investors in Asia, Latin America, Africa, CEE and the Middle East.

Programs leverage an unparalleled network of carefully vetted senior industry professionals and seasoned deal makers. Practitioner faculty combine a first-hand understanding of local contexts across regions with up-to-the-minute knowledge of global standards.

Each training features original, case-driven content in a live, virtual format that maximizes peer-to-peer learning and interaction with practitioner faculty.

Inside Private Capital trainings are free to GPCA and LAVCA Members as well as guests of DEG and FMO.

Upcoming Training

Negotiating with Co-Investors

October 27, 2022

This training will highlight the context for co-investment opportunities, and how to effectively close deals with LP partners. Practitioners include GPs leading co-investments, LPs who are engaging in the process, and funds of funds who will speak to their experience in negotiating and closing deals and discuss potential pitfalls.

This interactive session will:

- Discuss how to select LP partners who would work well for your opportunity

- Determine what LPs are looking for in co-investment and co-sponsorship discussions

- Structure your pitch to effectively bring co-investors on board

- Demonstrate how to coordinate with partners to close deals in a timely manner

Who Should Attend

Inside Private Capital trainings cater toward a diversity of individuals from GPCA and LAVCA’s various global regions, producing opportunities for relevant discussion and useful networking. Prospective attendees include fund managers and investment professionals working with portfolio companies.

Trainings are free to GPCA and LAVCA members, as well as GP guests of DEG and FMO.

See a list of firms that have attended previous trainings here.

Our Partnership

The Inside Private Capital series is sponsored by DEG and FMO in partnership with GPCA and LAVCA.

Virtual Medium

Inside Private Capital’s virtual format enables top-tier faculty, and participants located across the globe to come together to discuss one key topic, enabling a richer sharing of ideas in a convenient and low-cost format.

of program participants reported that they will be able to use or apply the knowledge gained through the training in their present role.

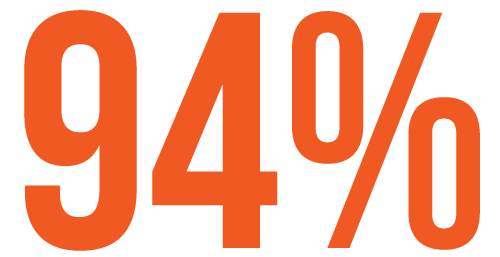

of program participants reported that they would recommend this program to others.

Practitioner Faculty

We engage faculty from institutional and fund investors in order to provide participants with different viewpoints and a comprehensive picture of the topic at hand.

Past training practitioner faculty members include:

Founding Partner and Asia Managing Director

TVM Capital Healthcare

E&S Development Specialist

IFC

Portfolio Operations Director, Environmental and Social

Navis Capital Partners

Vice President of ESG

HarbourVest

Senior Sustainability Manager

DEG Invest

Executive Director, Head of Asia Pacific

Morgan Stanley Alternative Investment Partners

Chief Executive Officer MVision

Chief Business Officer

The Everstone Group

Director, Responsible Investments

Actis

Partner

L Catterton

Partner

Scale Venture Partners

Chief Operating Officer

Cypress Creek Partners

Senior Partner and Chief Operating Officer

Navis Capital Partners

Senior Investment Officer

IFC

CEO & Co-Founder

Aequales

Founder and Managing Partner

Elevar Equity

Managing Director

Advent International Colombia S.A.S.

ESG Officer

TVM Capital Healthcare

Principal and ESG Chairman

HarbourVest

Partner

KKR

Past Trainings

Alternative Fund Structures: From Conception to Execution

August 2022

In this training, practitioner faculty will address how to design and implement alternative fund structures such as continuation and evergreen funds.

Implementing Effective ESG Practices

February 2022

Session 1: Consolidating and Communicating ESG Information

Session 2: Designing and Resourcing an Effective ESG Reporting Structure

Increasing Participation of Women in Private Capital in Latin America

October 2021

Session 1: First-Hand Insights from Industry Veterans

Session 2: Leadership’s Role in Attracting and Retaining Female Talent

Session 3: Overcoming Unconscious Bias at the Organizational Level

Cultivating LP Relationships in the Pandemic Era

July 2021

Session 1: Adapting LP Relationship Building to 2021 Realities

Session 2: Navigating Due Diligence in the Current Environment

Meeting LP Expectations on ESG

April 2021

Session 1: Fund Reporting: Fulfilling DFI and Commercial LP Requirements

Session 2: Practical Lessons for Implementing ESG in Companies and Projects

Alumni firms

Accion

Advent International

Affirma Capital

African Infrastructure Investment Managers

Africinvest

Alaya Capital

Alothon

Alta Growth Capital

Amadeus Capital Partners

Aqua Capital

Axxon Group

Baring Vostok

Beacon

CAF-AM

Capital Alliance Nigeria Limited

CASE IV

Cento Ventures

Cerberus Capital

Colony LatAm Partners

Crescera Capital

ECP Private Equity

Elevar Equity

EmergeVest

Equitas

Fondo de Fondos

Gemcorp

Gilsco Partners

GK Ventures

Gramercy Funds Management

Gulf Capital

Insitor

Iporanga Ventures

Jaguar Growth Partners

Kandeo- Asset Management

Leapfrog

Linzor Capital

LIV Capital

Loyal Valley Capital

Mediterrania Capital Partners

Mesoamerica

Monashees

Mubadala Capital

Myanmar Strategic Holdings

Northgate

Novare

Novastar Ventures

Open Space

PC Capital

Peninsula

Polymath Ventures

Portland Private Equity

Qualgro

Quona Capital

Riverwood Capital

Salkantay Ventures

South Suez Capital

SPE Capital Partners

Stepstone

TC Latin America Partners

Teja Ventures

The Yield Lab LatAm

TRG Management LP

Trilin C Global

TVM Capital

Unison Capital Inc

Volpe Capital